Master Fundamental Analysis with this 10-Step Guide: Learn How to Evaluate Stocks Like a Pro Investor

Introduction

Investing in stocks can seem complex, but one of the most powerful tools at your disposal is fundamental analysis. By evaluating key financial metrics, you can assess a company’s true value and make informed decisions about your investments. Master fundamental analysis with this 10-step guide, as we walk you through essential steps to evaluate stocks, starting from the basics and progressing to more advanced techniques.

1. Start with Industry Analysis

Before diving into the specifics of a company’s performance, it’s crucial to understand the industry in which it operates. The industry provides context for the company’s financials and can influence its future prospects. Industry analysis helps you assess:

- Market Trends: Understand whether the industry is growing, stable, or shrinking. Industries with high growth potential are more likely to provide profitable opportunities.

- Competitive Landscape: Assess the level of competition within the industry. Highly competitive markets may put pressure on margins and growth.

- Regulatory Environment: Some industries are heavily regulated, which can affect profitability. For example, healthcare and financial industries often face strict regulations.

By analyzing the industry, you’ll get a clearer picture of whether the company you’re evaluating is positioned for success or challenges in the long term.

2. Review Revenue and Earnings Growth

After assessing the industry, turn your focus to revenue and earnings. These are key indicators of a company’s financial performance:

- Revenue: Revenue growth is a sign that the company is successfully expanding its business and customer base.

- Earnings: Earnings (or net income) show the profitability of the company after all expenses are deducted. Consistent growth in earnings typically indicates a well-managed business.

Look for companies with strong, consistent revenue and earnings growth. Sudden drops in these metrics can be red flags for potential issues.

3. Examine Profit Margins

Profit margins are key to understanding how well a company is managing its costs and turning revenue into profit. Focus on two primary types:

- Gross Profit Margin: This reflects the company’s efficiency in producing goods or services.

- Net Profit Margin: This indicates how much profit the company retains after all expenses, taxes, and costs.

Companies with high or improving margins are generally more efficient and can handle cost fluctuations better than those with low margins. Shrinking margins may indicate problems like increasing costs or lower sales.

4. Assess the Company’s Debt Levels

Debt can either help a company grow or hinder its progress, depending on how well it’s managed. The debt-to-equity ratio is a key measure of financial risk. This ratio compares the company’s total debt to its shareholders’ equity:

- A higher ratio suggests the company is more leveraged and could face difficulties during economic downturns.

- A lower ratio indicates the company is more conservative with debt and may be less risky.

Be cautious if a company has excessive debt, especially if its earnings or cash flow aren’t sufficient to cover interest payments.

5. Analyze Return on Equity (ROE)

Return on Equity (ROE) measures a company’s ability to generate profits from its shareholders’ equity. A higher ROE indicates that the company is effectively using its equity capital to generate profits.

Look for companies with an ROE above 15%, which is often a sign of strong financial performance. Compare the company’s ROE to industry peers to assess how well it’s performing relative to others in the same sector.

6. Look at Cash Flow

Cash flow is vital for a company’s day-to-day operations and future growth. Free cash flow (FCF) shows how much cash a company has after covering capital expenditures, and it’s an important indicator of financial health.

- Positive free cash flow indicates that the company can reinvest in its business or pay dividends to shareholders.

- Negative cash flow, on the other hand, can be a warning sign of financial troubles.

Examine the company’s operating cash flow to ensure it’s consistently positive and growing.

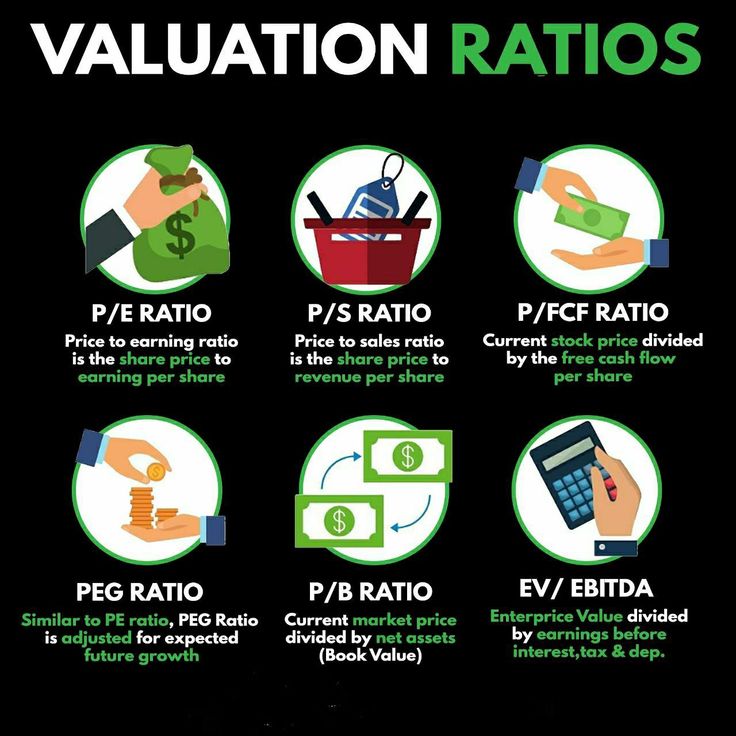

7. Evaluate Valuation Ratios

Valuation ratios help you understand whether a stock is overvalued or undervalued relative to its earnings and assets. Two key ratios include:

- Price-to-Earnings (P/E) Ratio: The P/E ratio compares the stock price to the company’s earnings per share. A low P/E might indicate the stock is undervalued, but it could also signal that the company is struggling.

- Price-to-Book (P/B) Ratio: This compares the stock price to the book value (net assets) per share. A P/B ratio under 1 might suggest the stock is undervalued.

These ratios give you a way to compare stocks within the same industry or sector.

8. Understand the Company’s Competitive Advantage

A company’s competitive advantage—often referred to as its economic moat—is its ability to maintain an edge over competitors. Look for companies with strong:

- Brand recognition: Companies with well-known brands have pricing power and customer loyalty.

- Proprietary technology: A unique product or technology can provide a company with a long-term competitive edge.

- Market dominance: Companies that control a large share of their market have more pricing power and can invest in growth.

Assessing a company’s competitive advantage helps you determine if it can sustain long-term growth.

9. Perform a SWOT Analysis

A SWOT analysis (Strengths, Weaknesses, Opportunities, and Threats) is a valuable tool for understanding a company’s position in the market:

- Strengths: What does the company do well? This could include strong financials, market leadership, or innovation.

- Weaknesses: What are the company’s vulnerabilities? High debt, weak management, or declining margins could be red flags.

- Opportunities: Are there new markets, products, or trends the company can capitalize on?

- Threats: What external factors could harm the company? Competitors, regulatory changes, or economic downturns could pose risks.

A thorough SWOT analysis provides a comprehensive picture of a company’s potential.

10. Monitor Market and Economic Conditions

Finally, it’s essential to keep an eye on market conditions and economic trends. These factors can significantly impact a company’s performance:

- Market Sentiment: General investor mood can influence stock prices, regardless of a company’s fundamentals.

- Economic Indicators: Inflation, interest rates, and GDP growth can all affect a company’s performance.

While it’s essential to focus on individual company metrics, never overlook broader market and economic factors that can influence stock performance.

Conclusion

By following Master Fundamental Analysis with this 10-Step Guide, you can evaluate stocks more effectively and make smarter investment choices. Start with industry analysis to understand the broader context, then dive deeper into financials like revenue, earnings, profit margins, and debt. As you gain more experience, you can analyze more advanced metrics like valuation ratios and competitive advantages.

By mastering fundamental analysis, you’ll be well on your way to making informed investment decisions and building a strong, diversified portfolio.

“Stay updated with the latest investing tips and financial insights—subscribe to our newsletter today and never miss an update!”