Personal Finance 101: How to Master Your Money: The Ultimate Guide to Achieving Financial Freedom

Introduction

Personal finance is the foundation of a secure and stress-free life. Mastering it may seem daunting at first, but with simple, actionable steps, anyone can take control of their money. Whether you want to save for a dream vacation, build an emergency fund, or prepare for retirement, Personal Finance 101: How to Master Your Money will help you get started on your journey to financial freedom.

1. Create a Budget That Works

Budgeting is the cornerstone of personal finance. It gives you a clear picture of where your money goes and helps you align your spending with your goals.

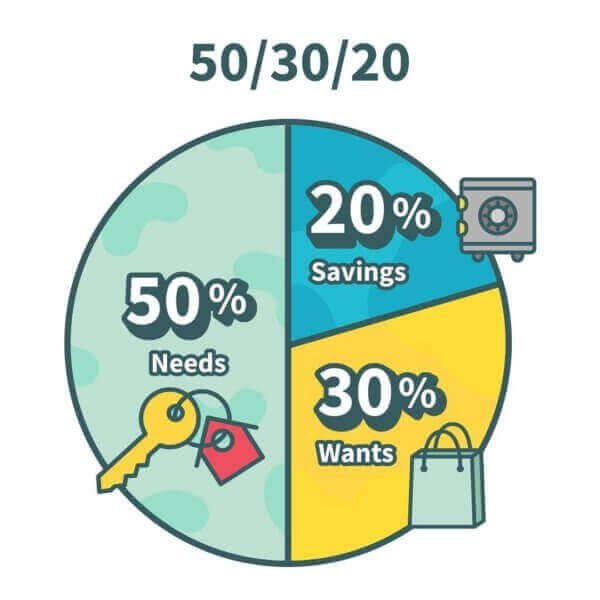

- Use the 50/30/20 Rule: Allocate 50% of your income to needs (rent, utilities), 30% to wants (dining out, entertainment), and 20% to savings or debt repayment.

- Track Your Spending: Use apps like Mint or YNAB to monitor expenses and ensure you stick to your budget.

- Adjust as Needed: Budgets aren’t one-size-fits-all. Review yours regularly and adapt it to your changing financial situation.

2. Build an Emergency Fund

An emergency fund is your financial safety net for unexpected expenses, such as medical bills or car repairs.

- Set a Target: Aim for 3–6 months’ worth of living expenses.

- Start Small: Begin by saving ₹5000–₹10,000 and gradually build from there.

- Automate Savings: Set up an automatic transfer to a dedicated savings account to make consistent progress.

3. Pay Off High-Interest Debt

Debt can be a major obstacle to financial stability. Tackling it early frees up money for other goals.

- Choose a Strategy:

- Snowball Method: Pay off the smallest debt first for quick wins.

- Avalanche Method: Focus on debts with the highest interest rate to save money in the long run.

- Negotiate Better Terms: Consider consolidating debts or asking for lower interest rates.

- Avoid New Debt: Stick to a cash-based system or use credit cards responsibly.

4. Save for Your Goals

Having clear financial goals makes it easier to prioritize your savings.

- Categorize Your Goals:

- Short-term: Vacation, gadgets, etc.

- Medium-term: Buying a car, down payment on a house.

- Long-term: Retirement, children’s education.

- Use Separate Accounts: Create individual savings accounts for each goal to track your progress easily.

- Leverage Recurring Deposits or SIPs: Automating your savings ensures consistency and discipline.

5. Start Investing Early

Investing helps grow your wealth and outpace inflation. The earlier you start, the greater the benefits of compounding.

- Understand Your Options:

- Mutual funds and SIPs for beginners.

- Direct equities for seasoned investors.

- PPF or NPS for safe, long-term investments.

- Diversify: Spread your investments across asset classes to minimize risk.

- Seek Professional Advice: Consult a financial advisor if you’re unsure where to start.

6. Protect Your Health

Health is wealth, and securing the right coverage is essential for peace of mind.

- Get Health Insurance: Health insurance covers medical emergencies, hospitalization costs, and preventive care, ensuring you’re financially protected during health crises.

- Consider Family Floater Plans: Some health plans cover the entire family, which can be more cost-effective.

7. Protect Your Life with Term Insurance

Term life insurance is essential to secure your family’s future in case of untimely death.

- Choose Adequate Coverage: Ensure your policy covers 10–15 times your annual income.

- Keep Premiums Affordable: Opt for a policy with affordable premiums while ensuring adequate protection for your family.

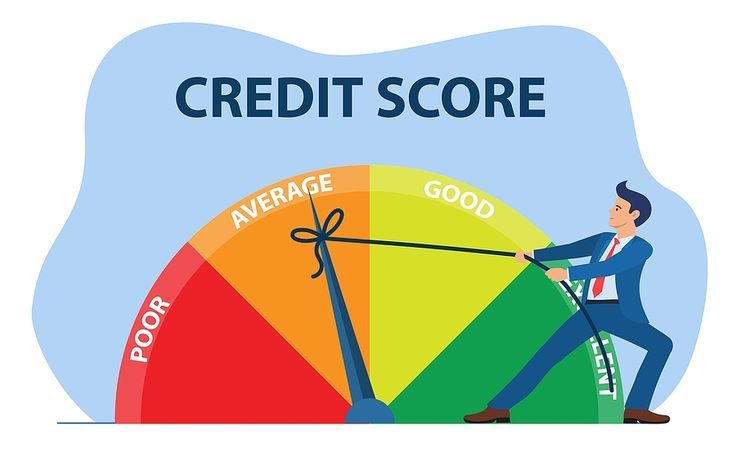

8. Monitor and Improve Your Credit Score

Your credit score plays a crucial role in your financial health, affecting everything from loan approvals to interest rates.

- Check Your Credit Report: Regularly review your credit report for errors or discrepancies. You can get a free report from major bureaus like CIBIL, Equifax, etc.

- Pay Bills on Time: Timely payments of credit card bills, loans, and other financial obligations positively impact your credit score.

- Keep Credit Utilization Low: Aim to use no more than 30% of your available credit to maintain a good score.

- Avoid Opening Too Many Accounts: Multiple credit inquiries can negatively affect your score. Apply for new credit only when necessary.

9. Plan for Retirement

The earlier you start planning for retirement, the more financial security you will have in your later years.

- Invest in Retirement Funds: Contribute to EPF, PPF, or NPS for long-term retirement planning.

- Consider SIPs for Retirement: Invest regularly through SIPs for compounded growth over time.

10. Build an Estate Plan

An estate plan ensures that your assets are distributed according to your wishes.

- Write a Will: Having a will ensures that your family is clear on how to handle your assets in case something happens to you.

- Consider Trusts: If your estate is large, consider creating a trust to minimize estate taxes and ensure smooth transitions.

Conclusion

Mastering your finances is a journey that begins with small, intentional steps. By following the principles outlined in Personal Finance 101: How to Master Your Money, you can build a solid foundation for long-term wealth and financial freedom. Start by creating a budget, building an emergency fund, and tackling your debts. Gradually, incorporate saving and investing into your routine while safeguarding your wealth with insurance.

Mastering personal finance is not just about understanding complex financial concepts but about taking action, step by step. In Personal Finance 101: How to Master Your Money, we’ve outlined practical, simple strategies that anyone can implement, regardless of their income or financial knowledge. This guide empowers you to take charge of your money, set clear goals, and build a roadmap for financial success.

By following the steps in Personal Finance 101: How to Master Your Money, you’ll be equipped to make smart decisions, stay on track, and achieve lasting financial freedom. Everyone’s financial journey is unique, and it’s important to celebrate the small wins along the way. The journey to financial mastery begins with a single step—start yours today!

What steps have you already taken to master your money and move closer to financial freedom? Whether it’s creating a budget, building an emergency fund, or starting your investment plan, we’d love to hear about it! Leave a comment below and share your experiences, questions, or any tips you have learned along the way. Together, we can learn and grow toward financial success!

“Stay updated with the latest investing tips and financial insights—subscribe to our newsletter today and never miss an update!”